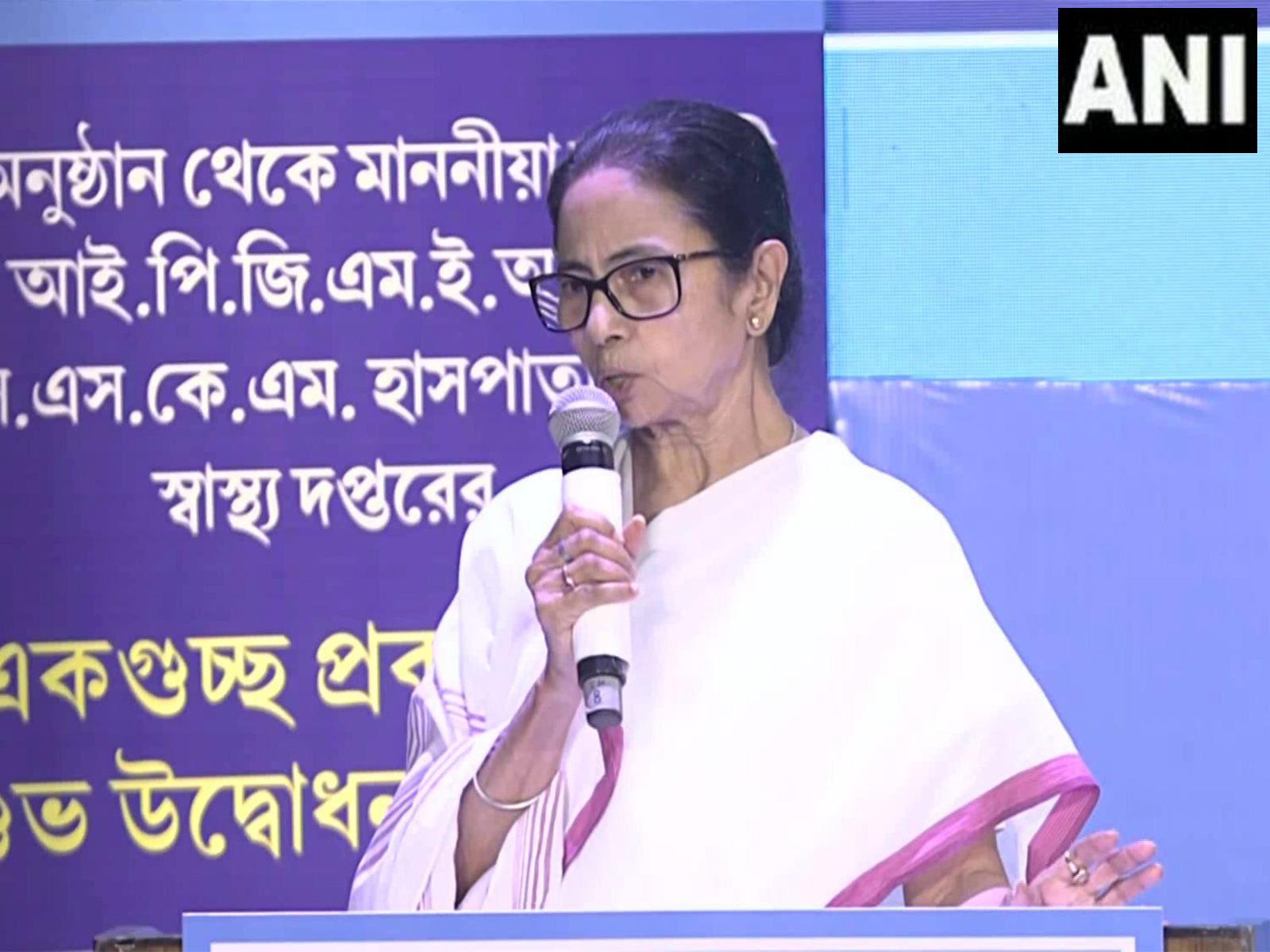

Kolkata (West Bengal) [India], September 22 (ANI): In the wake of the implementation of the revised Goods and Services Tax (GST) rates from today, West Bengal Chief Minister Mamata Banerjee criticised the NDA government and said that all the relief will come from the coffers of state governments, and the Centre did not spend a single penny.

CM Mamata Banerjee addressed the inauguration of the 25 Pally Club Durga Puja pandal on Monday.

CM Mamata Banerjee said, “There is no credit to the central government. I was the first to write a letter demanding that insurance be exempt from GST. Many life-saving medicines and small items had GST. The central government has not spent a single penny on this relief; it has all come from the coffers of state governments. They take the credit, but we have borne the cost.”

She expressed happiness that people will get benefits, but alleged that the money has been deducted from the state’s GST share.

“Will they return our money? Funds for 100 days’ work, for Awas Yojana, for roads, for Jal Swapno, for Sarva Shiksha Abhiyan: everything has been stalled. And now, again, a loss of Rs 20,000 crore has been inflicted. How will I run the state in such conditions? Still, I am happy that the people will benefit. But no compensation has been given; this money has simply been cut from our GST share. The so-called ‘double engine government’ will quietly take it back through back channels,” she added.

Earlier, Trinamool Congress leader Kunal Ghosh on Sunday criticised the next GST reforms and credited CM Mamata Banerjee and the All India Trinamool Congress (AITC) for forcing the Centre to make changes in GST rates, which he termed earlier as “anti-people”.

Addressing reporters, Ghosh said, “GST rates were actually anti-people…Because people use the product, there is more GST on it; there is more GST on health and life insurance. And when the rich and richest use the product, there is less GST,” he said.

He asserted that Mamata Banerjee raised her voice against the GST structure. “Mamata Banerjee raised her voice, and then the entire nation rose up against it. The Centre was forced to change the GST rates. Now they are trying to take credit for this, but why did you introduce such rates in the first place?” Ghosh asked. Then he said, “Because your tariff was anti-people.”

“The credit goes to Mamata Banerjee and AITC for pointing out the flaws and forcing them to bring these changes,” he added.

The reform in the Goods and Services Tax structure, which was approved during the 56th meeting of the GST Council earlier this month, is set to come into effect from today. The current four-rate system will be replaced with a streamlined two-slab regime of 5% and 18%. A separate 40 per cent slab has been retained for luxury and sin goods.

This new framework is expected to ease compliance, reduce consumer prices, boost manufacturing, and support a wide range of industries, from agriculture to automobiles and from FMCG to renewable energy. It is intended to lower the cost of living, strengthen MSMEs, widen the tax base, and drive inclusive growth.

In the fast-moving consumer goods (FMCG) and dairy sector, major brands like Amul and Mother Dairy have announced substantial price cuts, reflecting the full benefit of the GST reduction.

Items like milk, butter, ghee, paneer, cheese, ice cream, snacks, and frozen foods have been brought under the 5 per cent slab, due to which 100 g of Amul butter will now cost Rs 58 instead of Rs 62, and Ultra High Temperature milk (UHT) has dropped to Rs 75 per litre from Rs 77. Mother Dairy has also slashed prices on milkshakes, paneer, ghee, and frozen products. (ANI)

The article has been published through a syndicated feed. Except for the headline, the content has been published verbatim. Liability lies with original publisher.